“The minute you stop micromanaging

is the minute you're unsuccessful.”

—Lorenzo Fertitta

“Nobody took us seriously. Nobody —

except Donald Trump.”

—Dana White

“And the Fertittas really were

that magical jeweler for us.”

—Tom Barrack

“Where's my share?

Where's my equity?”

—Conor McGregor

“So, how you get into a situation, and then what

comes out of it, are completely different things.”

—Ari Emanuel

Ventures Now

Nevada Investments?

While Fertitta Capital is based in California, the Fertitta family has deep roots in Nevada, where Fertitta family-controlled casinos have made money from local residents since 1976. Some Nevadans have asked state and county economic development agencies whether Fertitta Capital will invest in their home state as Nevada seeks to diversify its economy by attracting start-up capital in tourism/gaming and information technology, fields that seem to overlap with Fertitta Capital’s interests.

Art-Washing

Fertitta funding of Trump agenda and labor rights abuses at Fertitta controlled casino lead to the Art Dealers Association of America being urged to stop selling art to the Fertittas. Letter here.

Ventures Then

Fertitta & Trump / Fiume Capital / Margin Loans / Raine & NFL / Nakisa Bidarian & the Fertittas / Fertitta Capital Up in the Air / Fertitta Capital at Sea? / Patient Capital / Optimistic Accounting / Teamwork & Bankruptcy / Gambling & Bankruptcy/ Colony Capital, Trump & the Fertittas / Failed Online Business / Pension Fund Losses / Fuller Access to Family Funds

Fertitta & Trump

The Fertittas have given $5,235,400 in financial support to Trump campaign entities since 2016.

Fertitta family members gave $3,028,400 to Trump Victory (see here and here), and one of the Fertittas gave $207,000 to the Trump Inaugural Committee.

Lorenzo and Frank Fertitta donated $2 million to America First Action, “the super PAC delegated by President Trump as his main conduit for big-donor spending.”

On the same day shown on the FEC receipts for the Fertitta’s America First contributions, FAA flight records show that two Fertitta-owned private jets flew to Charlottesville, VA. Though the President was in southern California that day, March 13, 2018, the Trump Organization owns an estate and winery in Charlottesville, with Eric Trump serving as President.

But it’s not only donor relations. Fertitta Capital hired a senior advisor from the Trump administration. Michael Britt, a former senior advisor to Secretary of Transportation Elaine Chao, became Fertitta Capital’s VP of Government Relations and Corporate Communications in March 2018.

Would you want to take advantage of or shy away from this kind of close ties to Trump?

Fiume Capital

Did Fertitta Capital become Fiume Capital? Do the Fertittas have three family offices?

The Fertittas debuted Fertitta Capital five years ago but now the Fertitta Capital website is blank, the Fertitta Capital chief investment officer holds the same role at Fiume Capital, another Fertitta Capital employee transferred to Fiume Capital (with Fiume Capital described as “Formerly Fertitta Capital”).

The Fiume Capital website is not blank, Fiume Capital shares an office address with Fertitta Enterprises, Fiume’s chief investment officer is the president of Fertitta Capital Inc., and Fiume Capital is the manager of Fertitta Capital LLC. Fiume Investments LP formed in January 2022 with Fiume Capital as General Partner, but no investments have been publicized to date.

If you’ve partnered with Fertitta Capital or Fertitta Enterprises, be sure to ask if Fiume Capital is now in charge of Fertitta investments and if Fiume is the third Fertitta family office.

Margin Loans

What do billionaires like the Fertittas use margin loans for?

The Fertittas cleared $870 million each in post-tax cash in the 2016 sale of the Ultimate Fighting Championship, according to an estimate by Forbes in August 2016.

Since 2016, Frank Fertitta III through FJF LLC pledged nearly 2.7 million Red Rock Resorts Inc. Class A shares on August 25, 2021 for a margin loan worth up to an estimated $118 million (2.7m X $46.17 x 95%). Frank and Lorenzo Fertitta pledged 6 million Red Rock Resorts Inc. Class B shares in September 2018 for a now-terminated margin loan worth up to an estimated $155 million.

The 2018 margin loan was from UBS AG, which promotes its securities-backed loans as useful for purchasing yachts or private jets, for bridge loans, personal expenses, business expansion, higher interest debt or loan consolidation.

We do not know which bank provided the 2021 margin loan. The Fertitta entity that took out the margin loan was formed on April 23, 2021 the day after Red Rock Resorts Inc. filed its annual proxy statement. No UCC has been filed in Nevada where FJF LLC is based, according to the Nevada Office of the Secretary of State.

Raine & NFL

Would Frank and Lorenzo Fertitta ask longtime collaborators at the Raine Group to help them acquire an NFL franchise?

TMZ reported Lorenzo Fertitta was “gunning to buy an NFL team” in 2019, and CBS Sports reported Frank Fertitta among potential buyers for the Carolina Panthers in 2018.

The Raine Group, founded by Joe Ravitch and Jeff Sine, has acted as a financial advisor to the Fertittas since 2007, including as a lead sell-side adviser in the sale of the UFC to Ari Emmanuel’s WME/IMG Holdings LLC in 2016, co-invested with Fertitta Capital in Moonbug Entertainment in 2018, and were exclusive financial advisor to The Beachbody Company in 2021 when Fertitta Capital committed to a private placement in Beachbody.

In addition to the Fertitta’s UFC sale, other Raine-involved sports deals include advising Ari Emanuel’s Endeavor in a $650 million deal with the NFL in 2020, advising Steve Ballmer in the $2 billion purchase of the L.A. Clippers in 2014, and overseeing the sale of Chelsea FC in 2022.

Nakisa Bidarian & the Fertittas

Has a Fertitta insider soured on his former employer, the UFC?

Nakisa Bidarian, a CFO when the UFC was Fertitta-owned, is business partner and advisor to Jake Paul, a celebrity boxer who criticizes the UFC and its president online for underpaying UFC fighters. And Bidarian’s BAVAFA Sports called a shareholder campaign upon UFC owner Endeavor to raise UFC fighter pay and healthcare “a brilliant move.”

Before Bidarian backed Paul and his campaign on the UFC, Bidarian was in the Fertitta business inner circle. In 2011, Bidarian “spent a lot of time with Frank, Lorenzo and their broader management team. And gained a lot of respect for their operating know-how, for their ethics, and how they ran their business.” Bidarian then went on to be SVP at Fertitta Entertainment and CFO at UFC, and finally CEO at Fertitta Capital.

Whether the UFC pays fighters enough is not a new debate, as it took place when Bidarian was UFC CFO under the Fertittas.

Now that Bidarian is outside the UFC, are there things he can do to the UFC that he couldn’t before?

Fertitta Capital Up in the Air

The Fertitta family collectively own three private jets (N721FF, N7UF, N77UF).

In the year following Fertitta Capital’s May 2017 public launch, the three jets made 587 flights, with 524 flights to these domestic destinations: Las Vegas, NV (262); Teterboro, NJ (46); Santa Monica, CA (45); Los Angeles, CA (45); South Bend, IN (44); Santa Ana, CA (20); Burbank, CA (9); Jackson Hole, WY (9); Miami-Opa locka Executive, FL (7); Westchester County, NY (5); and San Diego, CA (5). The jets also made 26 flights to these international destinations: the Bahamas (7); London (3); Paris (3); Los Cabos (3); Saint Martin (2); Rome (2); Düsseldorf (1); Málaga (1); Naples (1); Nice (1); Tokyo (1); Toronto (1).

Do you have business interests in or near any of these locations? If you do, definitely ask about borrowing these jets if you are negotiating with Fertitta Capital. We know there is an “Aircraft Time Sharing Agreement” between the Fertittas and the publicly-listed casino company that they control. Consider it a model for how you might also fly in private jets for your business adventures.

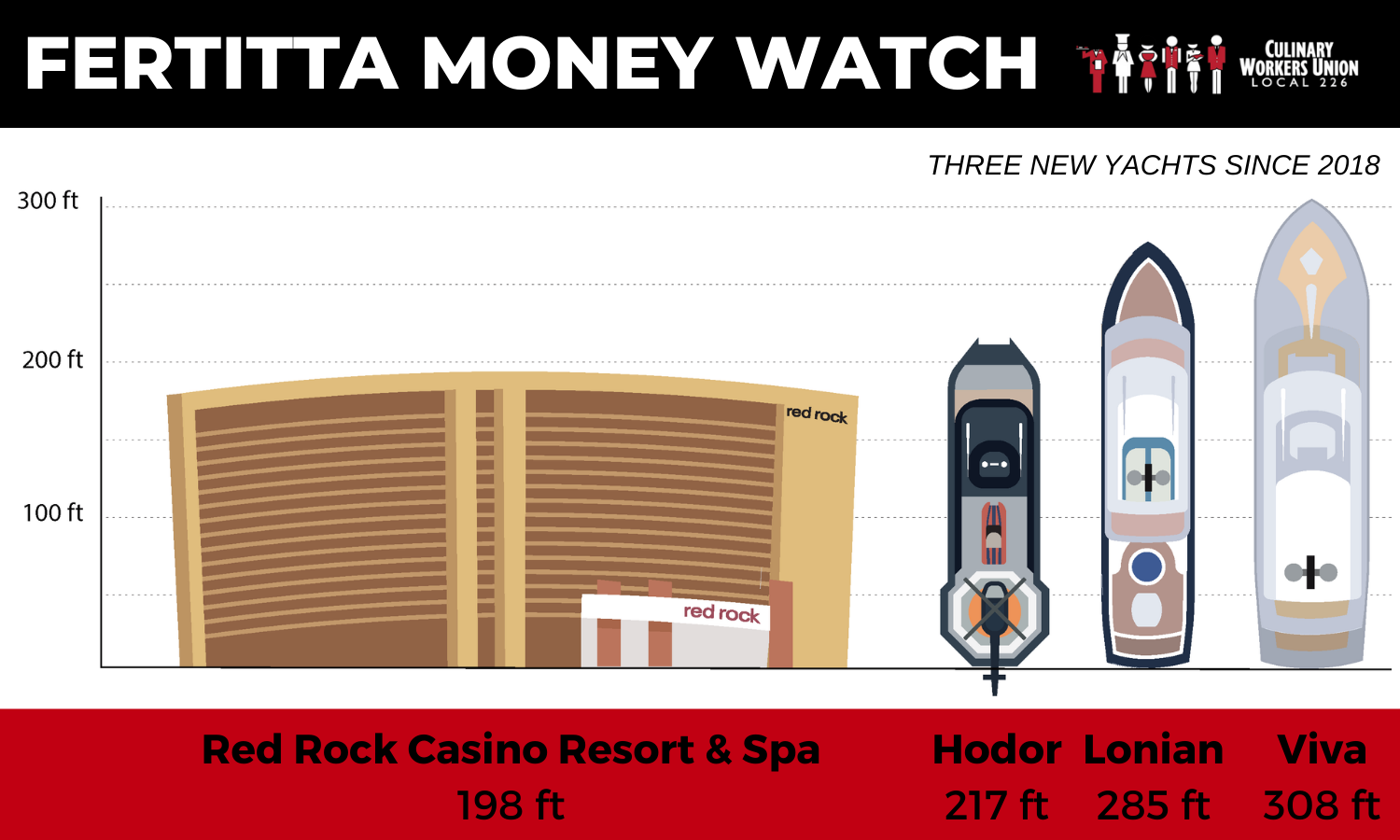

Fertitta Capital at Sea?

Will investees or other partners of Fertitta Capital have access to the family’s superyachts (yes, there are two), which are coming online?

While preparing to take their casino company public, two Fertitta family affiliates took out separate loans from Bank of America to finance the construction of mega-yachts. The financing was arranged through the maritime specialist law firm Bohonnon. One of the ships, the 87-meter/285-foot Lonian, was unveiled and launched in July by the Dutch builder Feadship, with exterior styling by Sinot Exclusive Yacht Design and interior design by Richard Hallberg. The other one, even larger at 94-meter/308-foot, is reported to be under construction.

Certain other family offices have or had dedicated staff for “aquatic endeavors” and “family yacht scheduling.” It’s unclear if management of Lonian and its sister ship will fall on staff at Fertitta Capital. And it’s also unclear if the Fertitta yachts would be deployed sometimes for business ventures like the Fertitta jets (as evidenced by the time sharing agreement with their casino company). But if you’re considering working with Fertitta Capital, make sure to ask if you may arrange for access to the superyachts as part of your deal with Fertitta Capital.

Patient Capital

It’s been widely reported that the Fertittas bought the UFC for $2 million 2001 and sold it for $4 billion in 2016. What’s less remembered now is how much additional funding they provided the company after the 2001 purchase.

The UFC “burned through more than $30 million in two years” after the Fertittas bought it, according to the Houston Chronicle. The Fertittas “invested $44 million more,” according to CNBC. And Fast Company reported that when the company produced [The Ultimate Fighter] on its own for $10 million, it gave it to Spike [TV] for free, and spent another couple million on ads and billboards. The reality-TV show turned out to be popular and became a turning point for the promotion.

Would other entrepreneurs have had recourse to the level of add-on financing – whether from their own pockets or angel investors – when things don’t go well in the first few years of their business? Will this be the type of patient capital one might expect from Fertitta Capital?

Optimistic Accounting

Another little-reported feature of the UFC story concerns accounting estimates and warnings from the Federal Reserve related to its $4 billion sale.

When bankers tried to raise $1.8 billion to fund WME-IMG’s purchase of UFC, they estimated post-buyout EBITDA of $298 million, even though the promotion had LTM EBITDA of $142 million as of 6/30/2016, according to Bloomberg reports based on people who asked not to be identified and documents obtained by Bloomberg.

Bloomberg later reported that in October 2016, regulators at the Federal Reserve focused on the use of “accounting adjustments [‘add-backs’] that more than doubled the mixed martial arts promoter’s cash flow projections” and issued a warning to Goldman Sachs, which led the loan syndication. By December that year, the Fed “reprimanded” Goldman for a second time and lowered its rating of the UFC loan to “substandard.”

Teamwork & Bankruptcy

The Fertittas, in partnership with Tom Barrack’s Colony Capital, took Station Casinos, Inc., private through a leveraged buyout in November 2007. The company eventually filed for Chapter 11 bankruptcy protection in July 2009.

The 2007 buyout paid company insiders – the Fertitta family, top executives, and directors – a total of $660 million in cash. On the other hand, following the buyout, SEC filings by the company show it terminated thousands of its “team members”, reducing the size of its workforce in Nevada by 20% from “approximately 14,600” in January, 2007, to “approximately 11,689” in January 2010.

After a new “Station Casinos LLC” emerged from Chapter 11 with the Fertittas still in control (after injecting $200 million cash equity into the company), the new firm would go on to pay LLC distributions totaling $617 million to its owners from 2012 through 2016.

To avoid going bankrupt, make sure you don’t overleverage your business for short-term financial gains. But with the right corporate structure, if things go wrong, it is possible to let the “team members” take the fall while you, the owner, still get paid.

Gambling & Bankruptcy

Russell Pike, a four-time convicted-felon, gambled more than $35 million at Red Rock Resort & Casino, one of the Station Casinos properties, in 2006 and 2007. Pike was also the founder of Xyience, an energy-drink company that sponsored the then Fertitta-owned UFC.

Fertitta affiliates made two loans to Xyience in 2007. The following year Xyience filed for bankruptcy, and Xyience would eventually be controlled by a Fertitta-owned business.

A few years later, in 2012, a Fertitta entity paid to settle claims it had extracted $1.03 million ahead of the bankruptcy of Xyience. In 2014, Xyience was sold for an undisclosed sum.

Colony Capital, Trump, and the Fertittas

Donald Trump and the Fertittas are jewelers, according to Tom Barrack of Colony Capital.

“The world is in a mess,” Tom Barrack claimed during his speech about Donald Trump at the 2016 Republican National Convention, “this necklace of globalism that we’ve all talked about has crumbled and shattered into a thousand shards. It needs a jeweler to take each of those jewels one by one, starting with America its own diamond and polish it. Then slowly, find seamless strength, [put] them all back together.”

Like Trump, the Fertittas are jewelers, according to Tom Barrack’s October 2007 Nevada Gaming Control Board hearing for approval of the Station Casinos leveraged buyout.

“The difficulty in the gaming business is in order to make rational sense out an operation, especially a company, you need to identify jewelers. You need to find those people of character and integrity and transparency who have that magical ability of taking a myriad of jewels and seamlessly hanging them together so that all you see is the necklace. You don’t see the individual jewel. And the Fertittas really were that magical jeweler for us.”

Nearly three years after claiming the Fertittas were magical jewelers, Tom Barrack said the timing of Fertitta-led partnership was the worst investment ever. “If you were to pick the hour, the minute that it could have been the worst investment ever, it was,” Barrack told Bloomberg in 2010.

Failed Online Business

Fertitta Capital CEO Nakisa Bidarian is reported to have said e-sports companies are pitching him proposals at a rate of two to three per week. But when it comes to moving into emerging business sectors, what’s the track record of principals behind Fertitta Capital? For due diligence, potential partners should examine an online casino venture called Ultimate Gaming.

Principals of Fertitta Capital led a first-in-the-nation “fledgling startup” in legalized online casino gaming, a supposed “long-term value driver” with 100 plus employees. But that venture generated operating losses of more than $80 million from 2012 to when it folded in the fourth quarter 2014.

When the Fertitta-led venture acquired the assets of CyberArts Licensing LLC in October 2011, they praised CyberArts as leading the industry in online products. When the website Ultimate Poker was launched in 2013, Ultimate Gaming promoted it as an “exhilarating” and “unmatched” poker experience, with an exclusive sponsorship deal with the UFC and poised to tap into Fertitta-led Station Casinos.

Yet when launched in April 2013, Vegas Inc reported that, “to the experienced online poker player, Station Casinos’ Ultimate Poker website can feel like a trip back to the Stone Age,” and initially customers with either Apple computers or service from Verizon could not play on the site. Despite inroads into New Jersey, the Fertitta-controlled site and its Atlantic City partner had the lowest gaming revenue of New Jersey’s six online gaming websites through August 2014.

What lessons did principals of Fertitta Capital learn from the experience? Was a first-mover advantage not enough to gain traction in a new field?

Pension Fund Losses

Is Fertitta Capital seeking co-investments from pension funds or other large institutional investors? Those types of potential partners should examine how a Texas pension fund lost more than $99 million after investing $100 million in the 2007 buyout of Fertitta-led Station Casinos.

According to the Dallas Morning News, the Chief Investment Officer of the Teacher Retirement System of Texas claimed in 2012 that while the $99 million Station Casinos loss was modest by Texas Retirement System (TRS) standards, it “was a bad investment.” The $100 million investment in 2007 was worth $516,000 in 2012, and according to the Dallas Morning News 2012 report, TRS did not expect to recover the losses.

When asked by the Dallas Morning News about a possible link between the Fertittas’ political support for Texas’ governor at the time of the buyout, Rick Perry, and the TRS investment in Fertitta-led Station Casinos, executive vice president and chief development officer for Station Casinos, Scott Nielson, not only denied any such relationship but stated that he was, “pretty sure that they [the Fertittas] couldn’t even have told you that the teacher retirement system invested in the [buyout].”

Fuller Access to Family Funds

Upon announcing Fertitta Capital’s initial $500 million fund, the family office’s chairman described the firm’s genesis as a direct result of the UFC transaction: “It was, ‘We’ve sold the UFC, we’ve got some liquidity, what do we do next?’” But prospective partners should also inquire about another half a billion dollars or so of additional “liquidity” that could become available through the family office.

The Fertittas are controlling minority owners of Red Rock Resorts, Inc., the parent company of Station Casinos that went public in May, 2016. Fertitta family entities were paid approximately $334 million in connection with the Red Rock Resorts IPO. Then, in April, 2017, Red Rock Resorts paid $120 million to purchase land from another set of Fertitta family entities (paying $98.4 million above fair market value).

When vetting Fertitta Capital, potential partners should determine how Fertitta funds beyond the family office’s initial $500 million fit into the firm’s claim of “access to permanent flexible capital.”

About

This site is maintained by UNITE HERE’s Culinary Union and not affiliated with Fertitta Capital, Station Casinos, or the UFC.

UNITE HERE represents 270,000 gaming, hotel and food service workers in the U.S. and Canada. UNITE HERE’s Nevada affiliates, Culinary Workers Union Local 226 and Bartenders Union Local 165, have a labor dispute with Station Casinos.

Press release: Culinary Union announces due diligence resource for prospective partners of Fertitta Capital